Dubai Marina: A Comprehensive Neighborhood Investment Guide

NIP Editorial Team

Investment Guide

Dubai Marina remains one of the city's most recognizable and sought-after addresses, combining waterfront living with urban convenience in a district that redefined Dubai's skyline. However, beneath the uniform "Dubai Marina" label lies remarkable diversity—building quality varies significantly, micro-locations create distinct investment profiles, and timing of construction impacts everything from layouts to rental potential.

Understanding these nuances separates successful Marina investments from disappointing ones. This comprehensive guide provides the insider knowledge enabling confident Dubai Marina investment decisions.

Marina Investment Snapshot

Typical gross rental yields by location

Waterfront premium over non-waterfront

Annual appreciation (quality mid-market)

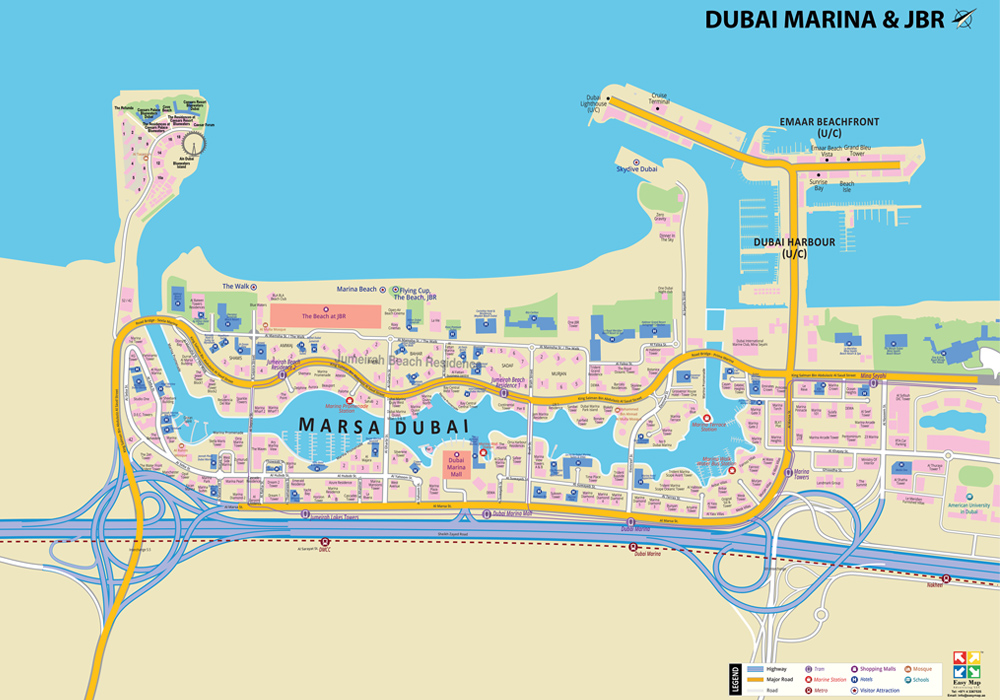

The Marina Landscape: Understanding the Geography

Dubai Marina isn't monolithic—it's a collection of distinct zones each offering different living experiences and investment characteristics.

🌊 Marina Walk (The Promenade)

Waterfront buildings with canal views, ground-floor retail, constant activity, premium pricing.

Buildings: Marina Quays, Escan Tower, Botanica, Dubai Marina Yacht Club, The Jewels

Best For: Capital preservation and tenant quality over maximum yields. 20-30% premium pricing but strong liquidity.

🏙️ Marsa Dubai (Inner Marina)

Set back from waterfront, offering Marina address without premium pricing.

Buildings: Marina Crown, Al Majara, Marina Pinnacle, Bonaire Tower, West Avenue

Best For: Yield-focused investors. Better returns due to lower purchase prices while maintaining Marina benefits.

🚇 Marina Gate & Mall Area

Adjacent to Dubai Marina Mall and Metro station. Strong connectivity.

Buildings: Marina Gate 1 & 2, The Torch, Princess Tower, Elite Residence

Best For: Professional tenant demand. Metro access ensures consistent occupancy and stable yields.

🏖️ Dubai Marina Residence (DMR)

Near JBR with extensive amenities. Family-oriented developments.

Buildings: Al Sahab 1 & 2, Shemara, Marina Mansions, Iris Blue

Best For: Family tenants with longer leases. Higher service charges but quality tenant base.

Building Quality Tiers: What Really Matters

Not all Marina buildings deliver equal quality. Understanding tier differences prevents costly mistakes.

⭐ Tier 1: Premium (2015+)

Modern design, energy-efficient, quality construction, well-managed.

Examples: No. 9, Marina Gate 1 & 2, Vida Residences, Dubai Wharf

Premium: 15-25% above older | Best For: Long-term holds, lower maintenance, better appreciation

✓ Tier 2: Solid Mid-Market (2010-2015)

Good construction, standard finishes, adequate management, functional amenities.

Examples: Grosvenor House, Marina Pinnacle, Botanica, The Jewels, Ocean Heights

Premium: Market baseline | Best For: Balanced investors seeking quality and value

⚠️ Tier 3: Older Stock (2007-2010)

Showing age, higher maintenance needs, variable quality, increasing service charges.

Examples: Marina Crown, Escan Tower, Al Majara, Bonaire Tower

Discount: 20-35% below newer | Best For: Experienced investors, higher yields, careful selection needed

❌ Tier 4: Problematic Properties

Significant issues, poor management, legal disputes, high vacancy, deferred maintenance.

Warning: Local intelligence essential for identification

Discount: 40%+ signals problems | Advice: Generally avoid unless severe discount with clear remediation plan

Unit Type Analysis: What Rents Best

Different configurations target different markets with varying yields and tenant stability.

Studios (450-600 sq ft)

7-9% YieldsBasic Buildings

AED 45K-60K

Quality Buildings

AED 55K-75K

Premium Buildings

AED 65K-85K

Purchase Prices: AED 700K-1.2M | Market: Single professionals, young couples, high turnover (12-18 months)

Investment: Maximum cash flow but higher management intensity. Best for hands-on investors prioritizing yield.

1-Bedroom (650-900 sq ft)

6-7.5% YieldsBasic Buildings

AED 65K-85K

Quality Buildings

AED 80K-105K

Premium Buildings

AED 95K-125K

Purchase Prices: AED 1.1M-1.8M | Market: Professionals, young couples, moderate turnover (18-24 months), largest pool

Investment: Sweet spot—good yields, broad appeal, reasonable management. Most liquid for resale.

2-Bedroom (1,000-1,400 sq ft)

5.5-7% YieldsBasic Buildings

AED 95K-125K

Quality Buildings

AED 115K-150K

Premium Buildings

AED 140K-180K

Purchase Prices: AED 1.6M-2.8M | Market: Families, professionals, sharers, longer tenancies (24-36 months)

Investment: Lower yields but better stability and quality. Higher absolute cash flow. Good for tenant retention focus.

3-Bedroom (1,600-2,200 sq ft)

5-6.5% YieldsBasic Buildings

AED 140K-180K

Quality Buildings

AED 170K-220K

Premium Buildings

AED 200K-280K

Purchase Prices: AED 2.4M-4.5M | Market: Families, executives, corporate relocations, long tenancies (30+ months)

Investment: Lowest yields but highest quality and stability. Significant capital requirement. Best for larger budgets.

Service Charge Analysis by Building

Service charges dramatically impact net yields and vary significantly across Marina buildings.

Service Charge Impact Example

Compare two similar 1-bedroom apartments (1,000 sq ft):

Property A (Low Service Charge)

Property B (High Service Charge)

Conclusion: Premium amenities don't generate sufficient rental premium to justify both higher purchase price AND service charges = 1.5% lower net yield.

Low (AED 15-22/sq ft)

Minimal amenities, basic services, older buildings.

Example: Marina Crown (AED 18/sq ft)

1,000 sq ft = AED 18,000 annually

Moderate (AED 23-32/sq ft)

Good amenities, quality management, reasonable facilities.

Example: Marina Pinnacle (AED 28/sq ft)

1,000 sq ft = AED 28,000 annually

High (AED 33-45/sq ft)

Extensive amenities, premium services and facilities.

Example: Vida Residences (AED 40/sq ft)

1,000 sq ft = AED 40,000 annually

Rental Market Dynamics

Understanding seasonal patterns and turnover rates enables realistic income projections.

🍂 Peak Season (Sep-Dec)

- • 15-20% higher rental rates

- • 2-3 week rental timelines

- • Multiple viewing requests

- • Less negotiation

Strategy: List for maximum rates and minimal vacancy

❄️ Moderate (Jan-May)

- • Market-rate pricing

- • 4-6 week timelines

- • Some negotiation

- • Good tenant quality

Strategy: Price competitively, maintain quality presentation

☀️ Slower (Jun-Aug)

- • 10-15% lower rates

- • 6-10 week timelines

- • Increased negotiation

- • Price-sensitive tenants

Strategy: Consider holding until autumn or seasonal pricing

Tenant Turnover Patterns

Studios: 40-50% annual turnover

1-Bedrooms: 30-40% annual turnover

2-Bedrooms: 20-30% annual turnover

3-Bedrooms: 15-20% annual turnover

Budget for vacancy periods and re-listing costs accordingly. Marina experiences higher turnover than family communities.

Capital Appreciation Trends

Marina's appreciation follows distinct patterns based on building quality and market positioning.

Historical Performance (2015-2025)

Future Outlook (2025-2030)

Expected Trends:

- • Continued 2-4% annual appreciation likely

- • Premium buildings outperforming older stock

- • Infrastructure improvements supporting values

- • Limited new supply (fully developed)

Positioning: Marina offers moderate appreciation with strong liquidity. Not maximum growth, but reliable steady performance.

Investment Strategy Recommendations

Match Marina property selection to your specific investment objectives.

💰 For Maximum Yield

- • Studios or 1-bedrooms in mid-tier buildings

- • Non-waterfront locations (Marsa Dubai)

- • Floors 10-25 (avoid ground and premium top)

- • Buildings with reasonable service charges

7-8%

Target Gross Yields

⚖️ For Balanced Returns

- • 1-2 bedroom in quality buildings

- • Mix of waterfront and non-waterfront

- • Mid to high floors

- • Buildings with good management

6-7%

Yields + Steady Appreciation

🛡️ For Capital Preservation

- • 2-3 bedrooms in premium buildings

- • Waterfront locations preferred

- • High floors with superior views

- • Top-tier management and amenities

5-6%

Yields + Stability + Appreciation

🎯 For First-Time Investors

- • 1-bedroom in established building

- • Reputable management company

- • Moderate service charges

- • Good transportation access

Lower Risk

Proven Demand + Simplicity

The NIP Marina Advantage

Our deep Marina market knowledge enables identification of best opportunities within this complex district.

Comprehensive Marina Intelligence

Building Intelligence

We track management quality, financial health, and owner satisfaction across all Marina buildings, guiding you away from problematic properties toward solid investments.

Micro-Location Expertise

We understand floor premium dynamics, view valuations, and noise exposure impacts enabling accurate pricing assessment and negotiation positioning.

Rental Market Insights

Our property management experience provides real-time rental demand data, seasonal patterns, and tenant preferences informing realistic income projections.

Transaction Volume

Our high Marina transaction volume creates negotiating leverage with sellers and listing agents, often securing better terms than individual buyers achieve.

Most importantly, we match properties to your specific objectives rather than pushing available inventory. Whether you prioritize yield, appreciation, or stability, we identify Marina opportunities optimizing your particular strategy.

Ready to Invest in Dubai Marina?

NIP's Marina expertise helps you navigate this complex market with confidence, identifying properties that deliver on your specific investment objectives.

Get Marina Investment Analysis

NIP – Novel Insight Property

Office Location

Office No: 113, Office 3

One Central – Sheikh Zayed Rd

Dubai, UAE